Bridging the Valley: Early-Stage Capital in a Post-Exit Drought

Navigating investors hitting pause before writing checks, dry powder, elusive customers in both BtoC and BtoB, and the KPIs that actually matter

The early-stage investing landscape is being rewritten. The first half of 2025 has reshaped early-stage capital raising, throwing familiar industry trends off balance and flipping best practices for flourishing upside down. What was traditional angel investing has become pulled into later stages, while founders need to prove themselves even more with revenue, true traction, and greater milestones. It’s time to unpack the whirlwind, from volatile markets to customers being more fickle to founders struggling with tariffs and investors navigating an exit drought with risk at an all-time high.

I have personally had so many conversations with founders about this exact topic, gleaning from hundreds of conversations with angel investors, early-stage VCs and ecosystem champions. I have synthesized the boots-on-the-ground insights and discussed them in private advisory or coaching sessions with early-stage founders (CPG, SAAS, life science, medical device, you know who you are). What rich conversations we have had! Then, I realized, I gotta share what we are talking about in meetings AND find if there are any data points or trends at a macroeconomic lens that strengthen how founders & funders are feeling at a microscopic level. AND I FOUND THEM.

To synthesize and provide insight on a bottoms-up approach from the field and the top-down analysis from my own research is what I live for, so here it goes. What I have seen is a cautious optimism from the leaders of the ecosystem and investor powerhouses. Even though the lingering exit droughts have chipped away at trust across the system, there’s still real hope because when investors see capital-conscious growth continuing to show up, especially in these economically volatile times, and it’s backed by actual revenue and rooted in grounded collaborations or partnerships that make B2B sales a little stickier, that hope feels earned. There is also a refreshing renewed emphasis on founder-institution trust in not only product and team development but being smarter in how to raise capital for the scalability of a company that withstands the tides of change, thus pushing both angels and VCs to reevaluate their playbooks.

Based on current investor behaviors, countless founder calls about current investors relations and fundraising, conversations at pitch events like San Diego Angel Conference Fund VII (we invested in 3 companies in June 2025), and market research from Silicon Valley Bank, Crunchbase, Techcrunch, Medium, and NVCA, I distilled & came up with some observations.

Here are the 7 strategies reshaping early-stage capital deployment:

Angels Are More Careful in Activating Capital

Early-Stage Investors: A True Barbell Strategy

Angel-VC Hybrids Are Active Again

Longer Due Diligence Is the New Edge

Revenue > Hype: Business Model Scrutiny Is In

Trust Bridges and Co-Investing Are at a Premium

Beyond the Buyer: Rethinking Revenue in a Volatile Market

Insights for these topics emerged from conversation and then were grounded by careful consideration through research & data reflection. Graphs and data shared have all of the pertinent references, albeit that most are data from VC rounds. The patterns may differ in scale, but I use these insights to postulate how shifts upstream are cascading downward, revealing the waterfall effects we’re seeing in early-stage angel rounds as well.

(1) Angels Are More Careful in Activating Capital

Across the board, angel investors’ liquid assets are lower, public markets remain volatile (so the strengths of their total wealth portfolio are not what they used to be & there are too many unknowns), and exits have slowed. Many angels are slowing their deal pace or pausing entirely due to a lack of recycled capital. When angels see successful exits, they often reinvest that capital into new startups. But in a prolonged exit drought or a desert, that cycle cracks and crumbles. The scarcity of liquidity events creates a kind of capital desert, and in those dry conditions, new deal activity suffers. Simply put: fewer exits mean fewer reinvestments, and that has a profound ripple effect on early-stage funding. In fact, the Q2 2025 NVCA Venture Monitor noted a 41% drop in new check writing among individual angels compared to Q2 2022. In addition, the ACA (Angel Capital Association) has long emphasized the importance of exits for angel reinvestment. Their data shows that angels who experience positive exits tend to reinvest at 2–3x the rate of those who don’t.

That’s not all, there is a median time to exit that investors estimate due to their own portfolio’s success, from those co-investors around them and in the market data. Pre 2025, we estimate 3-5 yrs for easy SAAS, 5-7 for SAAS, CPG and platforms, 7-9 for more complicated tech, and 10-15 yrs for medical devices and life science. (I know, investors reading this, might have slightly different numbers, it ranges, people). What we do know is that the median time to exit has INCREASED, median time to exit for venture-backed companies has extended to 9.8 years, up from 7.2 years in 2019. This delay significantly reduces the frequency of capital being recycled back into the early-stage ecosystem. Companies are also taking longer to raise subsequent rounds, in the early stages (pre-seed to seed) and later stages, like, take Grammarly, which secured $1 billion in funding from serial investor General Catalyst. Previously, the 16-year-old company had raised $400 million in venture funding, with its last round in 2021.

Aileen Lee, founder and managing partner at Cowboy Ventures, describes how her firm approaches early-stage investing:

“We don’t require product market fit or even a fully built product to want to invest in a team. We look for a unique insight into an underestimated category, and also pedigree, or a vision for a way better solution to an existing huge problem.”

Aileen was elected to be on the Business Insider’s list: “Seed 40: The Best Women Early‑Stage Investors of 2025”. A GREAT recognition.

(2) Early-Stage Investors: A True Barbell Strategy

Early-stage investors who are both angels (whether solo, part of angel groups, active in syndicates, or leading angel networks) and venture capitalists (as GPs, LPs, or members of funds) are increasingly adopting a split strategy in how they source, evaluate, and fund startups. Their capital reserves, if any, are being reinvested, protecting prior bets and supporting bridges to survival or Series A. That chasm between Seed and Series A is widening, not just in capital needs, but in the kind of strategic support founders need to navigate toward profitability, scalability, and sustainability. And the truth is, those paths look wildly different depending on the industry, making the climb harder and harder to map, let alone fund, and if VC funds are staying myopic, syndication and co-investing get harder and harder to fill larger and larger rounds.

At the same time, some are selectively reaching earlier into the funnel to identify high-upside companies, often relying on familiar markers like Stanford credentials, YCombinator badges, or recent exits. Pattern recognition is getting even more ingrained with such uncertainty. On the other end, angel investors—especially those with drier wallets due to stalled exits, are pulling back, moving later in the pipeline to avoid early-stage risk. Thus, a barbell strategy has been created, spikes of interest on either side of a continuum

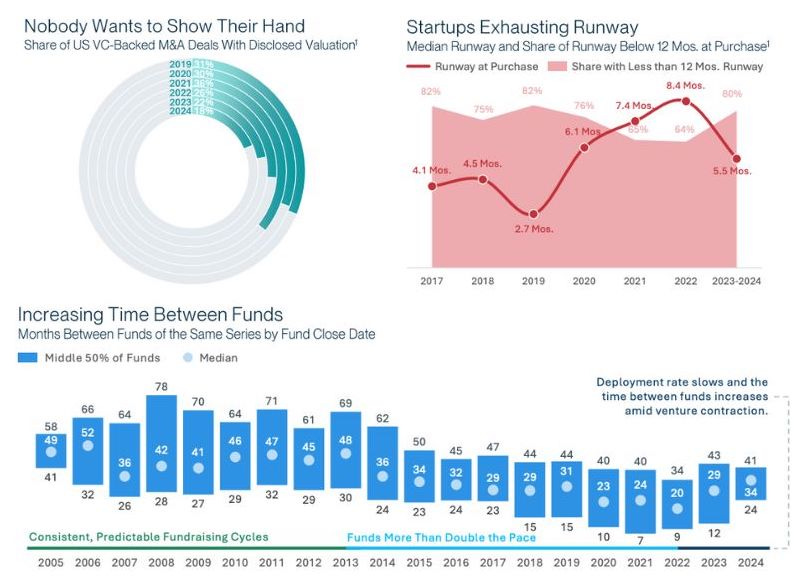

The reasons for all of this movement and risk mitigation, actually rooted in data? Plenty, but there are three (3) that I would like to call out. (1) First, many VCs are either at their last bit of dry powder or in that awkward in-between phase. During this venture contraction era, they are waiting LONGER to close their next fund, on average about 34 months, and deploying more slowly. As the SVB Report pointed out, the result is that VCs are less bold and more protective. (2) Second, there's a notable dip in M&A deal transparency, at an all-time low of 18% of the deals actually disclosing the details. This results in an ecosystem that has fewer data points in all stages because everyone is waiting for that elusive exit, more second-guessing, and LPs urging caution. Without clear exits on the horizon, VCs are doubling down on scalability and staying power. (3) And third, startups themselves are exiting with fewer months of runway than ever before, 5.5 months to be exact, from a high of 8.4 months in 2022. This only adds to the pressure to invest in companies as they are scaling within the time frame of the VCs sweet spot, deploying even more capital, to keep them afloat to appease the risk tolerances of their LPs.

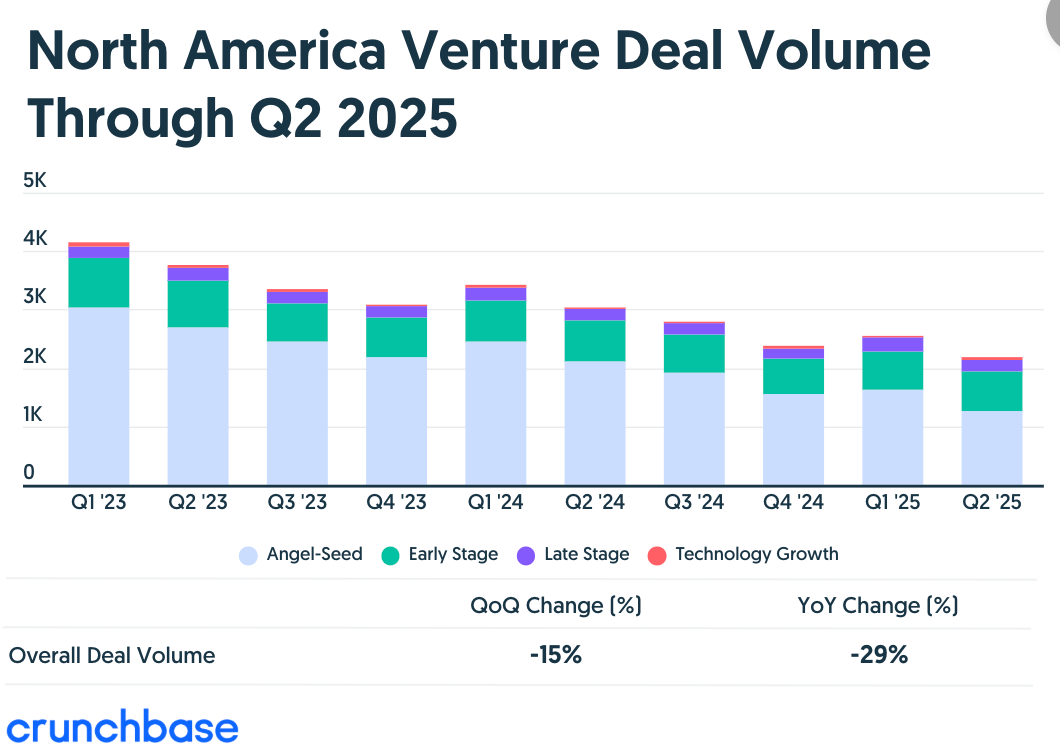

The result is a growing reliance on a barbell strategy: capital clusters at the edges, with VCs cautiously dabbling earlier, and angels hedging by investing later. In between lies the persistent valley of death, we all know it well, a widening chasm where dry powder sits idle, capital clusters are like large cracks in dry sand beds, angel groups offer only thinning hills of cash, and promising startups struggle to find their lifeline in a sea of sand instead of flushed rivers of cash. How do we know this? The data proves this. NVCA reports that 40% of seed rounds in Q1 2025 included crossover funds or growth-stage VCs looking for safer bets, and Crunchbase reports from 2025 Q2 that there was a 20% increase in pre-seed valuations, a sign of earlier bets from later-stage investors. This trend is where early-stage investors are clustering at two extremes of the investment spectrum, very early and much later, with less focus on the middle.

On one end of the spectrum: Investing earlier than ever (pre-seed, idea stage) to find high-upside opportunities before valuations increase.

On the other end: Waiting longer to invest (Series A or later) to reduce risk by backing startups with real traction (and those traction metrics are becoming even harder to achieve, from $1-2M of revenue for CPG in 2022 to $3-5M of revenue for similar stage companies in 2025)

In the middle: Traditional seed-stage investments are getting squeezed or delayed, asked to perform more, show more, and gain revenue earlier.

“We’re seeing pattern recognition on steroids—Stanford, YC, and second-time founders dominate early bets,” one GP told TechCrunch. This narrowing of prioritization stifles the spark & hope of innovation, crowding out fresh perspectives in favor of familiar pedigrees.

(3) Angel-VC Hybrids Are Active Again

The activity is sparse, but hopeful. Angel-VC hybrid investors began 2025 by doubling down on portfolio needs, deepening ties with existing portfolio companies, checking in frequently with founders and providing financial, operational, and strategic support, particularly in the wake of heightened caution post-election 2024. I heard so many of the startups I advise comment that investors are only evaluating existing portfolio companies or those they have been tracking for a while, and not accepting new opportunities. While some have started reopening their funnels to scout for new opportunities, their behavior still trails a cautious pattern shaped by the capital constraints of the past 18 months. Their funnels are staying open wider and longer to capture all while waiting for the sand to settle in this economic cracked-earth desert. Of particular interest is the continued success of San Diego Angel Conference, a member-managed fund, that was able to raise around $400K fund from over 50 investors to invest in 3 exceptional companies. FUND VII of San Diego Angel Conference funded 3 companies:

🥇 RECOUP | Co-founder & CEO Susan Buckwalter Hartman

$200,000 investment

🥈 Veera | Co-founder & CEO Tina John

~$100,000 investment (we raised more $$ since the Finale, so we were able to increase check size)

🥉Ciconia Medical | Co-founder & CEO Roni Cantor-Balan

~$50,000 investment (same as Veera)

🏅AUDIENCE CHOICE: #Veera | #TinaJohn CEO

SDAC invests in the BEST innovations, having a resilient and dedicated founding team that has high coachability, and a tech moat with large markets to account for consistent growth and scale. SOLID. Great early-stage investments … and for this gender-lens investor … just by chance, all top 3 have women CEOs with exceptionally diverse mixed gender leadership teams. BRAVAS!

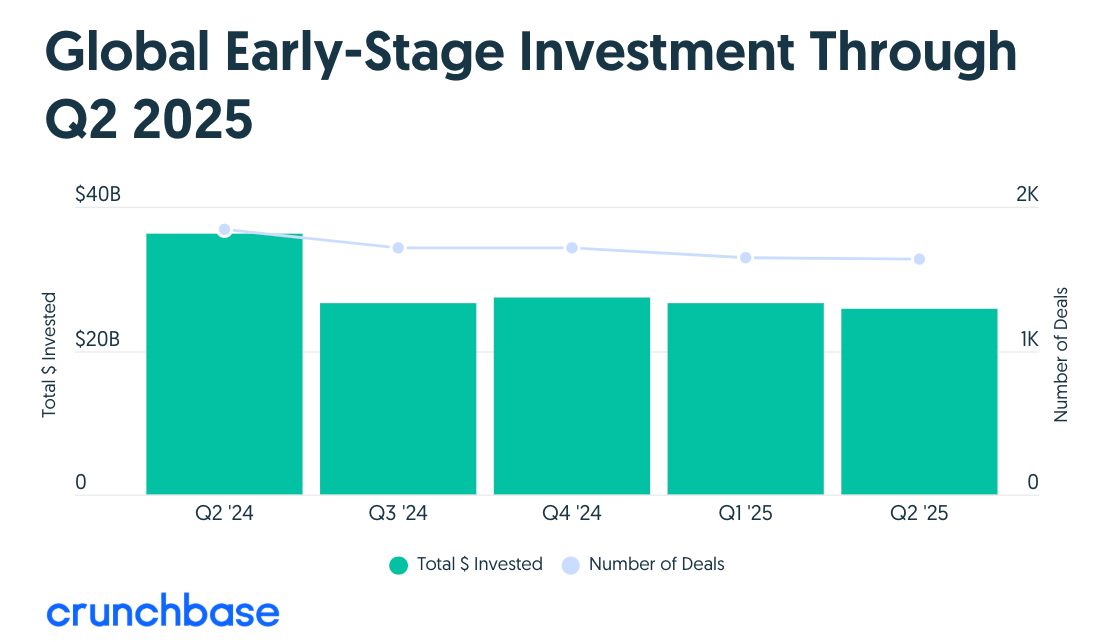

Overall, the early-stage investor ecosystem globally has been flat in the last 2 quarters of 2024 and the first two in 2025, as per Crunchbase data. Caution is at a high for all industries except AI companies, which have seen a blockbuster era of funding.

(4) Longer Due Diligence Is the New Edge

Ambiguity, coupled with the volatility of today’s markets, from fluctuating public valuations to economic uncertainty in customer behavior, pricing, and inflation, creates a cascading effect. What starts in the public markets ripples downward like a waterfall, reaching all the way into early-stage investing and reshaping how capital is deployed, evaluated, and withheld. One way to mitigate the increased perceived risk is to do a longer due diligence process of the companies, markets, customers, business model, etc. Deals now take 2–3x longer to close compared to 2021. Actually, Angel Capital Association reports that due diligence time is now averaging 42 days, up from 23 in 2021.

Due Diligence provides clarity around the decision-making of early-stage investors. At the core of due diligence, it involves identifying potential risks that could impact the startup’s launch & growth, then providing strategies to minimize or manage these risks.

In the last quarter of 2024 and into the first half of 2025, I am seeing investors ask for so much more from founders during due diligence, to decrease risk and bring some rigor to a very risky endeavor, riskier now than ever before. There are two ways that investors are seeking to find this: (1) increased scrutiny on real traction and (2) increased reliance on AI for screening and evaluating to decrease bias. Let me explain, the first reason is that investors want more than pitch decks. They want KPIs, realistic projections, and well-thought-out assumptions, and well-documented data rooms that all require unit economics, CAC/LTV, monthly recurring revenue, and runway visibility. This is no longer an era of pitching big ideas on napkins; it's about delivering small proofs—revenue, repeatability, runway. Founders need to grow trust with investors by raising investor confidence through demonstrated results. PERIOD. For early-stage founders, I talk about this all the time: “How do they get to the higher requirements of angel investors when they need funding to achieve them?” This is the million-dollar question. Every startup is wonderfully and uniquely made, so find your unique set of traction proof points that you can do with minimal funding, then move up from that as you gain a bit of funding from grants, pitch competition, and friends & family. The slow burn is of particular interest now, and the WHY behind that slow burn of cash and showcasing resilience. Of particular importance, deeper finance diligence, tied into revenue projections and burn analysis, is especially critical at Series A or B, and increasingly even at seed. The downstream need for analysis of startup companies mirrors the downstream sourcing of earlier deals to find that elusive unicorn (but with not do many bets as in 2022). The second reason is an increase in the reliance of AI tools to conduct, solely, in sourcing and selecting deals based on a pre-defined investment thesis and selection criteria. Bias is decreased, some good companies get passed, but most of the ones showcasing growth are evaluated with even more scrutiny. There are main factors to this evolution of the due diligence process, and those are primarily the volume & velocity of data, the rising complexity of markets, and the traditional resource constraints.

(5) Revenue > Hype: Business Model Scrutiny Is In

In the current chaotic climate, investors are asking for real business models that generate real revenue. Hype makes for more caution, and any ounce of risk could derail an entire sourcing+selecting process or due diligence journey. According to Crunchbase’s Q2 2025 North America Venture Funding Report, seed-stage funding surged to $5.9 billion, driven significantly by AI, marking the strongest quarter in three years, but there is also caution in that same gust of wind over a crackling desert. Beyond big headline rounds, the more meaningful shift is in the rising percentage of seed-funded startups bringing in recurring revenue, which has climbed dramatically.

Revenue traction at seed isn’t optional, it’s expected, even in the industries that traditionally have not expected revenue until 1-2 years post-launch. I found this especially true in the recent San Diego Angel Conference Fund VII experience, which reflected this shift. The startups that could illustrate revenue consistency, repeat buyer behavior, or pipeline contracts were viewed more favorably by angel-VC hybrids and led to their selection. For example, historically, a CPG company has a very hard time reaching the final 6 selected, and this year, a CPG startup won.

Even though seed-stage deal count is down slightly, despite funding totals rising, this indicates a posture of betting on more substantial, traction-backed startups. The dedication and strength of the founding team are also being evaluated in their drive towards revenue and capital-conscious business models. One last point is that investor confidence is increasingly data-driven. Decisions are being made with more caution and more research. With macro volatility in the background, on multiple fronts with economic shifts and financing uncertainty, revenue signals act as stabilizers. Startups with consistent income streams stand out, robust business models are enticing, and recurring revenue is golden.

(6) Trust Bridges and Co-Investing Are at a Premium

Trust is the most valuable currency in the early-stage investing world. It is at an all-time HIGH premium right now, carrying more weight than ever before.

Capital is cautious, and conviction grows through community and syndication. A reliance on warm intros, shared diligence, and syndication treaties is more valuable than ever. Groups like Golden Seeds, 37 Angels, and Stella Angels are syndicating more and building deeper collaboration across geographies.

This is another example of complete synergy between what I am seeing in the field and what the data shows. Investors who have really felt the drought of the early-stage ecosystem (exits, markets, etc) have become more reliant on syndication and networks. I know I rely much more now on my investor network of referrals, warm introductions, next step partners, and handoffs between pre-seed and seed or accelerator to angel group. That trust bridge is incredibly important. I have seen more co-investing and SPVs being formed because investors need to do more with less; more collective investing with less individual cash on hand to invest. They are putting their hard-earned network to work!. When investors are not able to deploy all of the capital they used to, especially when there is a brilliant founder with a transformative innovation, a large market, product-market fit, and founder-market fit, with the (appropriate) right valuation, it pains an investor to pass. They know who is investing in the stage they are also investing in, and it supports a growing innovation economy to introduce. It’s a founder-funder win-win.

You know me, the data tracks. In the annual ACA survey (May 2025), 82% of respondents rated "co-investor alignment" as a critical due diligence factor, up from 61% in 2022. On the path of making co-investing more structured, I have seen an upsurge of SPVs and SPV-managing platforms and solutions. Well, AngelList notes a 23% YoY increase in multi-group SPVs, attributed to the activity seen with founders & funders during investor relations advisory calls. So excited! This growing trend of consolidating the efforts of investors into SPVs or syndicates signals that investors seek to share the risk of early-stage investing instead of going solo.

7. Beyond the Buyer: Rethinking Revenue in a Volatile Market

It’s becoming clear that over-reliance on customer buying power is no longer a sustainable growth strategy—and that’s not necessarily a bad thing. In today’s volatile markets, with customer behavior more dynamic than ever, startups are being challenged to diversify revenue streams, deepen relationships, and build more resilient business models. Even in B2B, where loyalty and long sales cycles once felt predictable, shifts in procurement behavior are opening doors for new types of partnerships and long-term value creation.

This evolution pushes founders and investors to think beyond the quick sale and prioritize sustainable traction, strategic alignment, and ecosystem resilience. But the data is real, the SVB Q2 2025 report states that B2B SaaS churn rates rose by 11% YoY, a sign of budget tightening even in previously sticky categories. Also, in a Gartner 2025 B2B Buyer Behavior Survey, 77% of B2B buyers reported delaying new software purchases in Q1–Q2 2025 due to budget freezes or internal approval delays, a 9% increase from 2023 levels. On a larger scale, very interestingly enough, 60% of B2B decision-makers reported switching vendors in the past 12 months due to a mismatch in value delivery or pricing, up from 44% in 2022 (McKinsey & Company 2025). This highlights the growing volatility in customer loyalty and the need for startups to focus on consistent, long-term value creation. Having a posture of blessing customers or going one step further into co-creating with customers for a more ideal product and brand experience allows for better retention or “stickyness”.

Some hope? You all know it, AI. Investing in AI is not slowing down, just being more stringent in due diligence and the WHAT of the AI solution being developed. AI represents a powerful—though still unproven—catalyst for the innovation economy. Historically, it’s bold technologies like these that ignite recovery. Look for a future article that will dive deep into this topic.

I dove deep into these concepts and I am so glad I did. IN the last month, I have had so many discussions on this exact topic. Founders are become frustrated by chasing the next goalpost that investors place in front of them, investors are seeking better deals and lower valuations, markets are highly volatile, economic uncertainty is at an all-time high and the waterfall effect to the riskiest asset class, early-stage investing is feeling the burn, and thus, the founders we invest in.